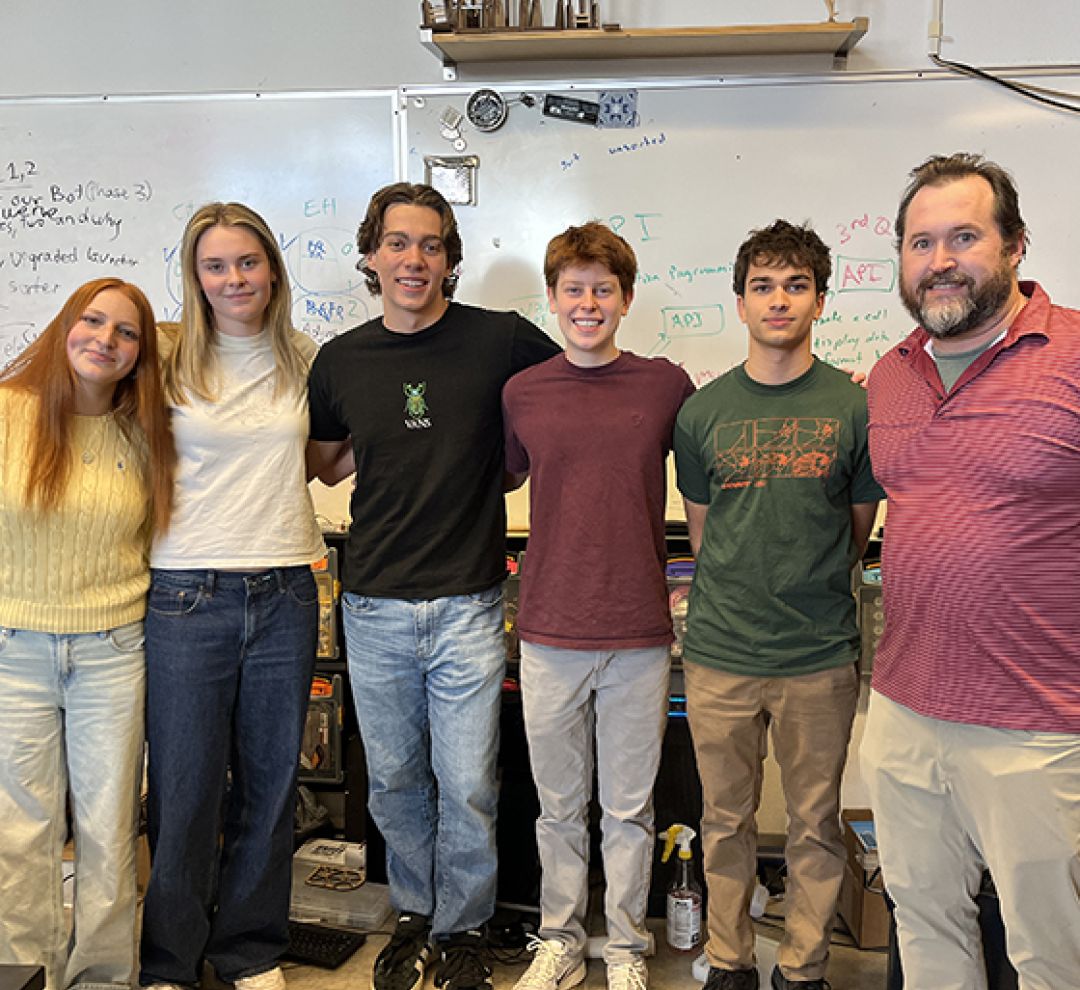

The Gregory Quant Capital team: Siena Paradies, Emerson Myers, Grady Jordan-Nowe, Solomon Alpert, Matt Capaldi (team leader), and Mr. Dennis Conner, advisor.

Investment Club students meet in Mr. Conner's classroom. Photo courtesy of TGS Investment Club.

TGS team advances in Wharton Global High School Investment Competition

When Matt Capaldi and Grady Jordan-Nowe, both Class of ‘27, approached Mr. Dennis Conner last year about starting an investment club, they had no idea that within a few months it would land them on an international stage. But that’s exactly what happened.

-Matt Capaldi '27

The initial idea behind the club was simply to learn about investing and how it works and to invite their peers to do the same. “Even if you don’t go into finance, knowing how to navigate the stock market is a really useful and interesting skill,” Grady said. But then Matt began researching the most prestigious investment competitions and discovered the Wharton Global High School Investment Competition at the Wharton School of the University of Pennsylvania in Philadelphia.

The Wharton Global High School Investment Competition is a free, international competition for teams of four to six high school students to develop an investment strategy based on a case study of a real life client. Students must create a plan to allocate the client’s money to reach their goals while meeting the client’s social concerns.

The 15-student investment club divided into three five-student teams and one of those teams, “Gregory Quant Capital,” composed of Solomon Alpert, Matt Capaldi (team leader), Grady Jordan-Nowe, Emerson Myers, and Siena Paradies (all class of ‘27), along with their advisor, Mr. Conner, is among the 50 international semi-finalist teams in the competition, out of the 6,300 teams that started. “We are one of three teams from Arizona to make it to this round in the last five years,” Grady said.

“The most exciting thing about this competition is that it gives you so much freedom, because it gives you a case study and it’s all up to you what to do with that money,” Matt said. “This allowed us to try out a ton of different interests and ideas.” Among the ideas, the team looked at internally diversifying stocks and wrote code to analyze S&P 500 stocks to determine their societal values and how they aligned with those of the client.

The program provides the teams with an investment simulator, allowing students to place trades and act on their investment strategies, thereby applying the concepts of investments and portfolio management and working with real-world data without risking real money. “I’ve always wanted to get into learning about investments, and having the opportunity to do so in such a natural environment was really cool,” Emerson said. “I think it’s one of the most important life skills you can learn.”

Along with the other 50 finalists, Gregory Quant Capital submitted a 10-minute virtual presentation to Wharton on February 9. They will soon be asked to answer written questions based on their presentation and then participate in a virtual interview with the program’s judges. Once this process is complete, the top 10 teams will be invited to Wharton to compete for the top place.

When asked if they have anything to add about the experience, the team laughed and agreed, “It was really hard!”

But, as Sienna added, “I went into this not knowing much about it. I was learning about investment as I went, and this project was such a fun way to learn.”

Congratulations to Gregory Quant Capital, and best of luck in the next rounds of the competition!