AZ tax credit costs you NOTHING to change a student's life

The Arizona State Tax Credit is not a donation. When you take the credit, you direct funds you have already paid, or are obligated to pay, in state taxes to help provide need-based scholarships for Gregory School students. Directing your state tax liability to The Gregory School costs you nothing.

Everyone’s taxes are different, but if you work in Arizona, you probably have an Arizona tax liability. This means that you paid state taxes, even if you do not “owe” money. If you have an Arizona tax liability, you can take the credit.

Who can take the credit?

Individuals, couples, and S and C corporations who pay Arizona state taxes. You do not have to "owe" money when you do your taxes to participate.

Who benefits from the tax credit?

TGS students

The Gregory School predominantly partners with the following STOs:

Why Support TGS?

You have made a profound difference in my time as a student and my future.

What do I/we have to do?

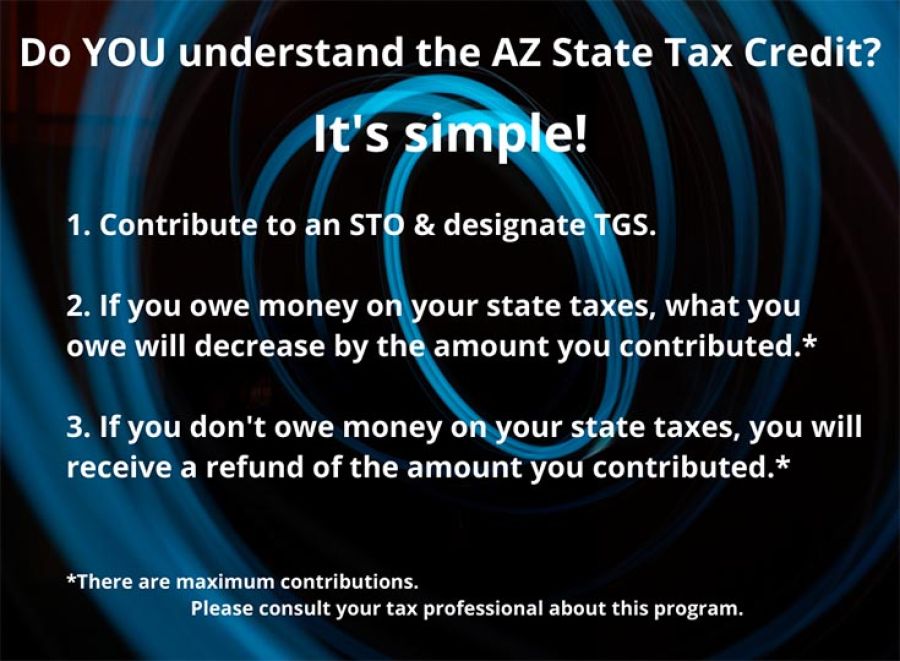

Contribute funds to a School Tuition Organization and designate The Gregory School as the recipient of the contribution. When you do your taxes, the dollar amount you contributed is credited to your state taxes. This means:

- If you owe money, you will now owe that amount less.

- If you are due a refund, your refund will now be that amount bigger.

- If you are going to break even, you will receive the amount you contributed from the state.

- Contributing has no ultimate effect on your bottom line.

How much can I/we contribute?

There is a limit to how much an individual or couple can contribute. For 2020:

- Single filer maximum contribution = $1,183

- Married filing jointly maximum contribution = $2,365

You cannot receive credit for more than your tax obligation. For example, if you are a single filer and your state tax obligation (either what you paid/what was deducted from your paycheck or what you have to pay) is $700, you can contribute up to $700. If you are a single filer and your tax obligation is $4,000, you can contribute up to $1,183. Please consult your tax advisor about the appropriate contribution for you.

After you make your contribution, the STO disburses the funds to The Gregory School to help students who receive need-based tuition assistance attend TGS.

Can my family, friends, and I contribute for a specific student?

Some of the STOs we work with will accept and disburse funds designated for specific students, whether or not those students have financial need as determined by the school. This means that families of all income levels can ask friends and relatives to participate in the tax credit to benefit their student. The student's parents or legal guardians cannot direct the credit to their own student, nor can parents/guardians participate in a "credit swap" with another family or families.

What happens on Arizona Tuition Connection’s Match Day?

On Tuesday, December 1, all individual/joint tax credit contributions made to Arizona Tuition Connection that day to benefit The Gregory School will be matched by Arizona Tuition Connection. Funds directed to a specific student will be matched, but the matching funds will be disbursed to the TGS pool of funds for need-based tuition assistance students and will not go specifically to the recommended student.

Corporate Tax Credit Information

Who can participate?

Arizona S and C corporations

Who does it benefit?

TGS students who have applied and been approved for TGS tuition assistance and who meet the definition of low income as defined by the state for this purpose. The corporate tax credit cannot be directed by a corporation to a specific student.

What does the corporation have to do?

- Working through a School Tuition Organization (STO), the corporation applies to the state to participate in the program at a specific dollar amount. The application process is extremely simple. Please contact asaposnik@gregoryschool.org if you need to be connected to an STO.

- The state informs the STO once the application is approved and the corporation gives the STO the funds.

- The state credits the corporation that amount on their taxes. This means that the corporation has re-directed a portion of its tax dollars to the STO. For example, if the corporation was going to pay $15,000 in state taxes and was approved to send $10,000 to the STO to benefit low-income TGS students, the corporation would now pay $5,000 in state taxes.

- It ultimately has no effect on the corporation's bottom line.

- TGS collects the funds from the STO to help pay the tuition of a qualified student or students.