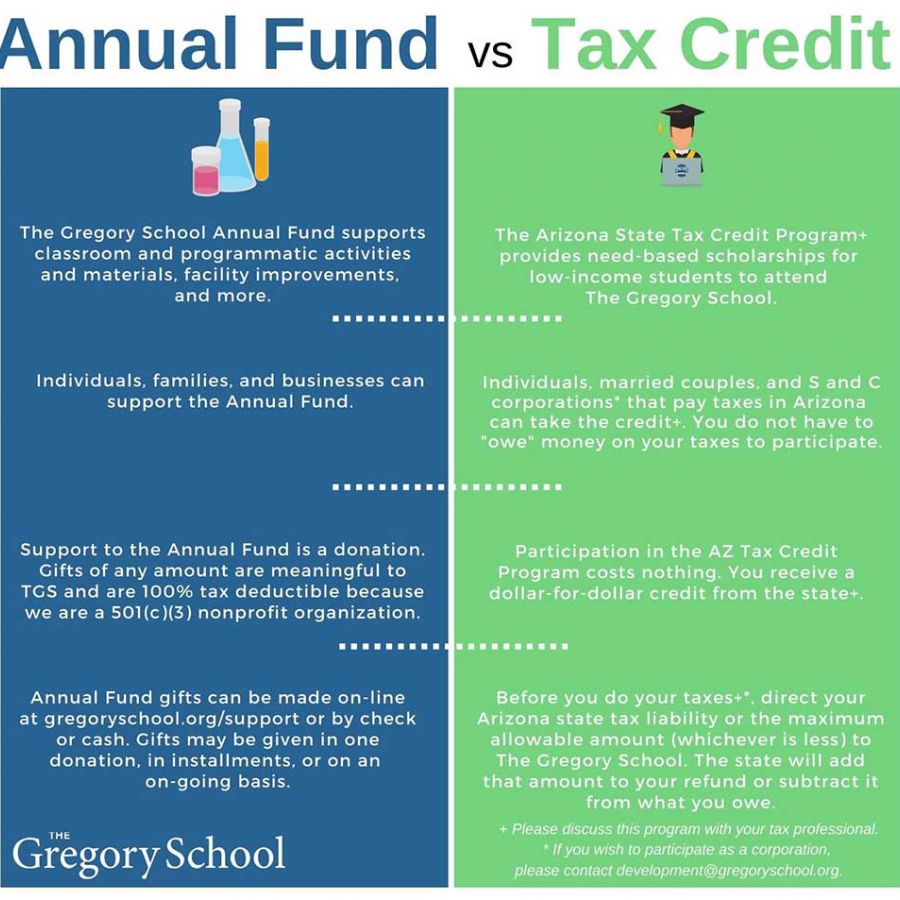

Annual Fund vs. Tax Credit: How are they different, and how can you help?

TGS Annual Fund

To support The Gregory School Annual Fund is to help pick up where tuition leaves off, making our extraordinary, closely personalized education possible here every day for every student.

As is the reality for nearly every independent, non-profit school in the United States, tuition covers only about 75% of a Gregory School education. The difference is made up through grants from private foundations, endowment draws, and the generosity of individual donors, including current families, grandparents, alumni, and community members.

Annual Fund gifts help purchase everything from Fab Lab equipment and art supplies to robotic tournament entry fees, athletic transportation and accommodations, school vans, library acquisitions, royalties for theater productions, and everything in between.

Our own faculty, staff, and board of trustees make a 100% commitment to supporting the Annual Fund each year, and we ask that our current families do the same, at the level that feels appropriate and comfortable for them.

Gifts to The Gregory School Annual Fund are 100% tax deductible and may be made online on our donation page or by check, with Annual Fund in the memo line, sent to:

Attn: Annual Fund

The Gregory School

3231 N. Craycroft Rd.

Tucson, AZ 85712

Arizona State Tax Credit

The Arizona State Tax Credit program helps provide scholarships for students from low-income families to attend The Gregory School.

Contributing to the Arizona State Tax Credit program is not a donation, and it costs nothing to participate. Rather, participants re-direct Arizona income tax dollars that they have already paid or are obligated to pay to help provide TGS scholarships.

Individuals, couples filing jointly, and Arizona S and C corporations may all participate in the Arizona Tax Credit program.

Participants determine the amount that they can contribute based on the amount of income tax they paid (or will be expected to pay) during the tax year and the maximum allowable contribution. That amount is then credited back to the participant by the state of Arizona, either as a refund or a credit against what is owed. (You will either owe less or get a larger refund equal to the amount of your contribution.)

You do not have to "owe" money when you do your taxes. If you worked in Arizona during the tax year, you can probably participate.

Tax credit contributions should not be sent to The Gregory School. Contributions must go through one of our partner School Tuition Orgranizations (STOs). Links to some of our partner STOs and to the year's maximum contributions and other information are found on our support page. It is recommended that participants work with their tax professional when taking the tax credit.